By Nathan Ham

Property owners in Watauga, Avery and Ashe counties should all feel pretty good about what they actually get for the taxes that they pay.

According to a recent study from SmartAsset, all three of those counties rank in the top 10 in North Carolina for getting the most our of their property tax dollars.

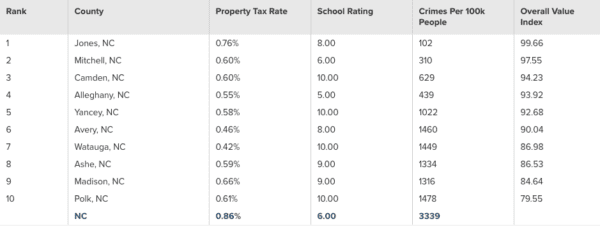

The study, which has been done each year for the last five years in North Carolina, compares the amount of money spent on property taxes that go back to each county versus school rankings and crime statistics for the county, since police forces, schools and other public utilities are often times the largest benefactor of tax revenue.

Watauga, which has one of the lowest tax rates in the entire state, ranked seventh on the list. Avery County ranked sixth overall and Ashe County was eighth overall.

According to SmartAsset, calculations start by providing a 1-10 score based on math and reading proficiencies in each school district. After that, a “community score” is calculated by forming a ratio of school rankings to the combined number of violent and property crimes in each county per 100,000 residents. Next up, they used the number of households, median home value and average property tax rate to calculate a per capita property tax collected for each county.

The final calculation comes up with a tax value number by creating a ratio of the community score to the per capita property tax paid. This shows the counties in the state where people are getting the most bang for their buck, or where their property tax dollars are going the furthest.

Jones County was first place overall, followed by Mitchell County in second, Camden County in third, Alleghany County in fourth and Yancey County in fifth. Madison County was ninth and Polk County was 10th. Eight of the top 10 counties are all in Western NC.

You must be logged in to post a comment.